Introduction

Whether you’re stepping into the world of traditional finance or the fast-evolving crypto markets, mastering trading and investing strategies is crucial. But before you start clicking “Buy” or “Sell,” you need a solid foundation. This guide walks you through essential concepts like risk management, technical indicators, and portfolio balancing, all designed with beginners in mind.

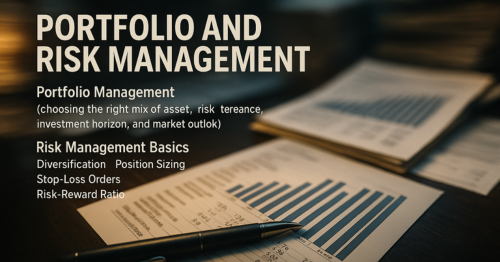

Portfolio and Risk Management

Smart investing begins with spreading your risk, never rely on a single asset to carry your entire financial future.

What is Portfolio Management?

Portfolio management involves choosing the right mix of assets (stocks, Crypto, ETFs, etc.) to meet your financial goals while minimizing risk. An effective portfolio is tailored to match your comfort with risk, your long-term financial goals, and your view of the market landscape.

Risk Management Basics:

- Diversification: The distributing your investments across various industries and asset types to reduce overall risk.

- Position Sizing: Never invest more than a set percentage (say, 1-2%) of your portfolio in a single trade.

- Stop-Loss Orders: These automatically sell an asset when it falls below a set price, limiting potential losses.

- Risk-Reward Ratio: Ideally, only take trades with a risk/reward ratio of at least 1:2, risk ₹100 only if you aim to gain ₹200.

Pro Tip: Beginners often ignore risk management in the hope of quick profits, this is one of the fastest ways to lose money.

Trading and Investing Strategies

Understanding your style is key. Are you an active trader looking for short-term gains, or a long-term investor seeking growth?

Day Trading and Swing Trading

Day Trading

- Day trading is when you buy something like a stock or crypto and sell it before the day ends, so you don’t hold it overnight.

- Focuses on technical analysis and quick decision-making.

- Requires discipline, speed, and constant market monitoring.

Ideal for investors who can dedicate ample time and possess solid chart-reading skills.

Swing Trading

- Positions are held from a few days to several weeks.

- Traders try to earn quick profits by buying low and selling high within a short time.

- Combines technical and fundamental analysis.

Best for: Beginners who want a balance between active and passive strategies.

Scalping and Buy & Hold

Scalping

- Extremely short-term trades, sometimes just seconds or minutes.

- Focus is on small gains from micro price movements.

- This type of trading needs special tools, quick decision-making, and a lot of buying and selling.

Note: Not recommended for beginners due to its intense nature.

Buy and Hold

- This is a long-term approach where you buy assets and hold them for several years.

- Based on the belief that markets rise over time.

- Less stressful and ideal for wealth creation.

Best for: Beginners and long-term crypto or stock investors.

Understanding Technical Analysis Indicators

Technical analysis uses charts and past price movements to help you figure out the best time to buy or sell. Here are key indicators every beginner should learn:

Moving Averages (MA)

- Smooth out price data to identify trends.

- Common types: Simple Moving Average (SMA) and Exponential Moving Average (EMA).

Relative Strength Index (RSI)

- It helps you spot when an asset might be overpriced (above 70) or underpriced (below 30).

- Helps anticipate price corrections.

MACD (Moving Average Convergence Divergence)

- Shows momentum and trend direction.

- Watch for MACD line crossovers and zero-line reversals.

Bollinger Bands

- Indicate volatility and potential breakout zones.

- When the bands stretch far apart, it signals the asset is going through big price changes and higher risk.

Pro Tip: No single indicator is 100% accurate, use at least 2-3 indicators together for confirmation.

Trading Psychology: Mastering Emotions

Understanding charts and strategies is only half the game; controlling your emotions is the other half, and often the harder one. Many beginners lose money not because they lack technical skills, but because they can’t manage fear, greed, or impatience.

Why Trading Psychology Matters

- FOMO (Fear of Missing Out): Entering trades late just because the price is pumping leads to losses.

- Panic Selling: Reacting emotionally to small dips often means selling low and buying back high.

- Revenge Trading: Trying to recover losses quickly only compounds mistakes.

- Overtrading: Taking too many trades without setups due to anxiety or excitement drains your capital.

Tips for Emotional Control

- Stick to Your Strategy: Create a plan before the trade and don’t deviate mid-way.

- Accept Losses Gracefully: Not every trade will work. Take it as a learning opportunity.

- Use Stop-Losses: Let automation protect you from emotional decision-making.

- Keep a Trading Journal: Record every trade with entry/exit reasons, outcome, and your emotions, this builds discipline and self-awareness.

Pro Tip: Long-term success comes from controlling yourself more than the market.

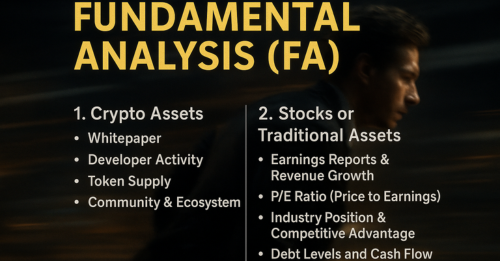

Fundamental Analysis (FA)

While technical indicators help you understand price trends, fundamental analysis helps you understand value. This is especially critical when investing in crypto projects or stocks over the long term.

What is Fundamental Analysis?

Fundamental analysis (FA) is the process of evaluating the core health, utility, and potential of an asset based on qualitative and quantitative data.

For Crypto Assets:

- Whitepaper: Understand the project’s mission, utility, and tokenomics.

- Developer Activity: Check GitHub for regular code updates and team involvement.

- Token Supply: Review total, circulating, and inflationary supply, scarcity impacts value.

- Community & Ecosystem: A strong, engaged community often supports long-term adoption.

For Stocks or Traditional Assets:

- Earnings Reports & Revenue Growth

- P/E Ratio (Price to Earnings)

- Industry Position & Competitive Advantage

- Debt Levels and Cash Flow

Pro Tip: A coin or stock with solid fundamentals is more likely to recover from market downturns, and thrive long term.

Building a Well-Balanced Crypto Portfolio

Crypto markets are volatile, but that doesn’t mean your portfolio should be chaotic.

Key Principles:

1. Diversify by Market Cap

- Large-cap coins (e.g., Bitcoin, Ethereum) offer stability.

- Mid and small-cap coins can offer higher returns but come with greater risk.

2. Allocate by Purpose

- Core Holdings (50–60%): BTC, ETH—long-term assets.

- Growth Picks (20–30%): Altcoins with strong fundamentals.

- High-Risk, High-Reward (10–20%): New projects or meme coins.

3. Rebalance Quarterly

- Crypto prices change rapidly. Rebalance every few months to maintain your desired allocation.

4. Use Stablecoins

- Keep a portion in USDT, USDC, or DAI to hedge against volatility and buy during dips.

Bonus Tip: Always store your crypto in reliable wallets—hardware wallets are safest for long-term holdings.

Conclusion

Trading and investing are not about chasing hype or getting rich overnight. Success comes from understanding your strategy, managing risks wisely, and consistently learning. Whether you’re into scalping, swing trading, or building a crypto portfolio, having a structured approach will give you an edge in the markets.

Frequently Asked Questions

What’s the difference between trading and investing?

Trading involves short-term strategies focused on quick profits, while investing is long-term and aims at wealth accumulation over years.

Is day trading suitable for beginners?

Not usually. Day trading is fast-paced and risky. Beginners should start with swing trading or long-term investing to build experience.

How much money should I start with in crypto trading?

Start small, ₹1,000 to ₹5,000 is enough to learn. Never invest money you can’t afford to lose.