The Indian crypto sector is an opportunity-rich industry, but highly unpredictable. The price swings and instability intrigue traders who try to capitalize on the market’s rapid ups and downs and make quick gains. But despite the rewarding opportunities, there is a flip side. High risks, indiscipline, and impulsive trades can drain a trader’s portfolio and cause heavy losses.

Whether you are a beginner, trying your luck in crypto trading, or a seasoned Indian trader, crypto trading strategies will help you navigate the market, manage risks, and make profits easily.

By the end of this post, the 5 best crypto trading strategies 2025 every Indian must know, you will learn about the different types of crypto trading strategies and understand which aligns best with your investment goals. Ready to supercharge your trading game? Let’s begin.

What are Crypto Trading Strategies?

A crypto trading strategy can be defined as a roadmap, structured framework, or guidance that enables you to steer the market, understand price swings and entry and exit points, and make informed decisions.

Crypto trading strategies are necessary for profitable and successful trading, reducing risks, avoiding panic-driven or emotional trading, and protecting your assets from unexpected financial risks.

Must-haves for good crypto trading strategies:

- Market analysis through trading charts, indicators, selecting the right crypto, etc.

- Help traders understand entry and exit points (time to buy and sell) of trading.

- Proper risk management to avoid financial losses.

- Ascertain the timeframe, like long-term or short-term trading.

- Avoid emotional trades or impulsive decisions.

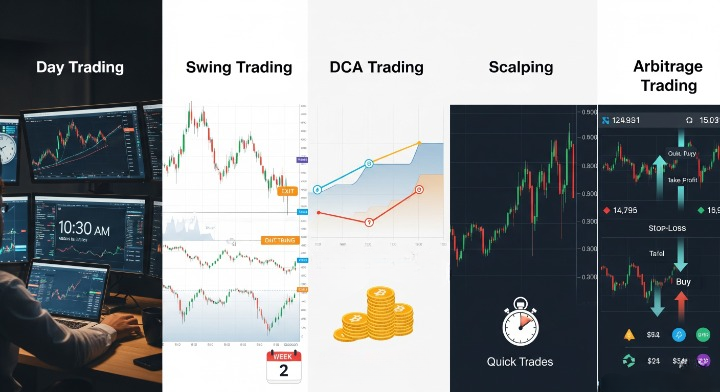

5 Best Crypto Trading Strategies 2025 For Indian Investors

In India, the crypto market is rapidly evolving, creating ample opportunities for retail investors and big enterprises.

Here are our top 5 picks of the best crypto trading strategies in 2025 for Indian investors:

Day Trading

Day trading in crypto is a type of short-term trading. Typically, a trader tries to capitalize on the market volatility and price swings within the same day to make quick profits. The trader seeks profits on intraday price movements (usually 24 hours) and withdraws the same day.

Day traders use high-end technical tools, market charts, trading signals, and indicators to understand when to trade or exit the market. Generally, seasoned and regular investors venture into day trading. They leverage the market fluctuations, make quick and calculated decisions, and act swiftly to capitalize on the short-term price swings.

Key Considerations

- Highly liquid crypto: These assets have high demand. It is easy to get prospective buyers and sellers for these assets in the market, execute trades, and make big profits.

- High volatility – Sharp price movements can open doors to great possibilities and earning opportunities.

- Trading volume – High trading volume indicates high liquidity and a good opportunity to do crypto day trading.

- Technical aspects – Understand the technicalities of trading, monitor, and study price patterns before indulging in trading.

- Follow trends – Keep yourself updated with the latest market events and news, and the performance of the specific crypto in the market.

Earnings Outlook

Earnings from day trading depend on your risk tolerance, capital investments, and expertise. Traders can earn anywhere from ₹5,000 to ₹50,000 per day from multiple trades.

Pros

Traders can make multiple quick profits through price volatility throughout the day.

Crypto markets are open 24/7. Traders can utilize the opportunity to make profits and withdraw the same day.

Cons

Day trading is fast-paced and requires commitment, comprehensive knowledge, and technical acumen.

It can be stressful for beginners. More suitable for savvy investors who know how to ride the market.

Swing Trading

It is defined as a medium-term crypto trading strategy that extends up to a few days or weeks. It is a smart strategy that utilizes the goodness of slow and steady trading and long-term holding, bypassing the intense drive of day trading.

Traders profit from crypto price swings occurring within a few days or weeks. There is no rush like day trading. The traders do not need to hold crypto for months or years.

Key Considerations

- Identify support/resistance: Consider the support/resistance levels to understand when to buy or sell the asset to maximize profits.

- Moving average (MA): To understand short-term and long-term price movements within a specific period.

- Relative strength index (RSI): This indicator ascertains whether the crypto asset has been overbought or oversold. An RSI over 70 signals overbought, which indicates a good selling point. Anything below 30 signals oversold, which is a good entry time for buying.

- Trading volume: High trading volume reveals strong trader interest and market sentiment. This determines the entry and exit points in swing trading.

Earnings Outlook

Swing trading is a quick profit-generating strategy. The earnings are comparatively higher than day trading. However, it also depends on price volatility. The bigger the volatility, the more the profits. Profits can range between 10% to 40% depending on market conditions.

Pros

- It is more flexible than day trading and does not require constant monitoring.

- The profit potential is higher.

- Trading is less exhausting than day trading.

- Traders can make profits from the various ups and downs of the market.

Cons

- Requires patience and discipline.

- Frequent trades incur higher transaction fees.

Dollar-Cost Averaging (DCA)

DCA is a long-term crypto trading strategy that involves fixed and regular investments, irrespective of price movements. This strategy balances the average purchase price of the crypto asset, spreads out the risk, and reduces price volatility risks. For example, you have decided to purchase a crypto asset worth ₹100,000. So, instead of spending the whole amount to buy the crypto, you spread the investments in short and equal instalments. You make 5 purchases of ₹10,000 each. This averages or smooths out the cost per coin and amplifies overall returns. DCA is one of the best crypto trading strategies for long-term Indian traders who avoid emotional trading, spread the risks into multiple purchases, and are eager to build a steady portfolio.

Key Considerations

- Fixed and regular investments: You commit a fixed purchase at regular intervals, which can be weekly, biweekly, or monthly.

- Automate strategy: Integrate with a crypto exchange and automate the process for consistent returns.

- Price-agnostic module: It is not influenced by market price changes.

Earnings Outlook

DCA can deliver solid and consistent returns for long-term investors. It reduces risks against price volatility.

Pros

- DCA spreads purchases over a long period and provides a hedge against price volatility.

- Lowers the average purchase cost and is profitable for beginners.

- It is simple and does not trigger irrational purchases.

Cons

- Traders may miss opportunities for substantial gains from market highs and lows.

- Steady but slow returns and may not be suitable for aggressive investors.

Scalping

Scalping or scalp trading in crypto is a short-term trading approach. Scalp traders make repeated profits from small price movements in highly liquid markets. Here, the traders do not hold their crypto in the market for a long time, but instead make profits from multiple trades throughout the day from temporary price fluctuations.

Key Considerations

- Bid-ask spread: The “bid” price is the highest price a buyer will pay for a crypto. The “ask” price is the lowest price the seller is offering. The difference between the bid and the ask price is the “bid-ask spread.” They indicate the entry and exit positions.

- High liquidity and volatility: A highly liquid and volatile market is profitable for scalping. Traders seize the opportunities and profit from quick trades.

- Technical analysis and tools: Scalp traders rely heavily on market data, indicators, signals, technical analysis, and tools.

- Speed and precision: Scalp trading is a disciplined approach and requires quick action and precision.

Earnings Outlook

Scalping in crypto trading is considered highly profitable, as it involves quick and frequent gains within a short time.

Pros

- High earning potential for both small-time traders and experienced traders.

- Less risky, especially for novice traders.

Cons

- High transaction fees on multiple trades.

- Requires precision and expertise.

Arbitrage Trading

Crypto arbitrage trading is an innovative approach. The trader makes a profit by buying the crypto asset at a low price from one crypto exchange and selling it on another exchange at a high price. The price difference is the profit. To make profits, you must have accounts on these platforms. The key is to stay alert and make quick decisions to seize the opportunities.

Key Considerations

- Price disparities: Actively monitor the real-time price movements across multiple exchanges and capitalize on the price differences.

- Swift trades: Identify the price differential, make quick decisions, and execute speedy trades to lock profits.

- Automation tools: Many traders utilize crypto trading bots to execute trades. This saves time and is less stressful.

Earnings Outlook

Earnings largely depend on the exchanges. Some exchanges may yield higher profits while others charge hefty trading and withdrawal fees, reducing the overall profit share. High liquidity ensures faster trades and lower slippage, enhancing the overall crypto earnings.

Pros

- Low risk and quick profits. It is a good trading strategy for traders looking for substantial returns.

- High gains within a short time. Automated trading tools further enhance the profits.

Cons

- Exchange outages or technical glitches may impact trading.

- High trading fees in certain exchanges may reduce overall earnings.

How to Choose a Crypto Trading Strategy?

Choosing a crypto trading strategy ultimately depends on your trading goals, time commitment, risk tolerance, and skills.

Busy professionals often prefer long-term investments like dollar-cost averaging and use trading bots to save time and effort. Seasoned and full-time traders prefer day trading or scalping as it requires skills, market know-how, and commitment.

Ultimately, it depends on the trader’s preference and expertise. Most traders learn from trial and error. Experienced traders often combine multiple trading approaches to mitigate risks and optimize profits.

How Crypto Trading Strategies Maximize Earnings?

The crypto industry is ever-changing with boundless opportunities. To navigate this vast space, you need a well-designed strategy that guides and disciplines you and prevents emotional and impulsive investments.

Crypto trading strategies set predefined rules based on real-time market data and price movements. They prevent missed opportunities, offer a hedge against risks, and prevent unforeseen losses.

Additionally, different trading strategies cater to the specific needs of individual traders and ensure successful trades and higher earnings.

Closing Thoughts

Crypto trading strategies are the key to trading success. They help you understand the nuances, the unique benefits, and challenges of different types of crypto trading. Our guide offers a curated list of the 5 Best Crypto Trading Strategies 2025, a must-have for every Indian trader looking to refine their trading skills. So, no more delays. Get ready to traverse the dynamic market of crypto trading with confidence and ease.

Taniya is a Content Writer with over 6 years of experience in the industry, specializing in Web3, crypto, Blockchain, Tokenization, and Decentralized Finance. She is passionate about creating compelling and well-researched narratives, navigating readers through the emerging trends and dynamic world of Web3 and Decentralized Finance.