$116M Bitcoin Investment – Harvard Backs BlackRock. In a significant move that’s sending ripples through the financial world, Harvard University’s prestigious endowment fund has invested $116 million in BlackRock’s Bitcoin ETF. This bold step showcases how even the most traditional institutions are beginning to embrace digital assets as a legitimate part of their investment portfolios.

For years, cryptocurrency was often seen as a speculative venture, but times are changing. Institutional participation, like Harvard’s latest move, signals a broader shift toward the mainstream adoption of Bitcoin and blockchain-backed financial products. BlackRock’s Bitcoin ETF, being one of the most reputable and regulated options in the market, has made it easier for large-scale investors to gain exposure without directly holding the cryptocurrency.

This also reflects a broader financial transformation where digital assets are becoming part of long-term investment strategies. As central banks explore digital currencies and global regulations tighten, Bitcoin ETFs provide a bridge between innovation and security. Harvard’s decision may inspire other academic institutions to reimagine how endowment funds can benefit from the high-growth potential of blockchain-based investments while mitigating risks through regulated financial products.

Why This Investment Matters

Harvard’s endowment is one of the largest in the world, with assets exceeding $50 billion. Their decision to allocate $116 million to BlackRock’s Bitcoin ETF indicates a growing trust in Bitcoin’s long-term value. It also reflects a recognition that digital assets can play a vital role in portfolio diversification, potentially offering high returns while hedging against inflation.

Institutional investors often act as trendsetters in the financial industry. When they make moves toward emerging asset classes, others tend to follow. This investment could inspire more universities, pension funds, and asset managers to explore Bitcoin ETFs as a safer gateway into cryptocurrency.

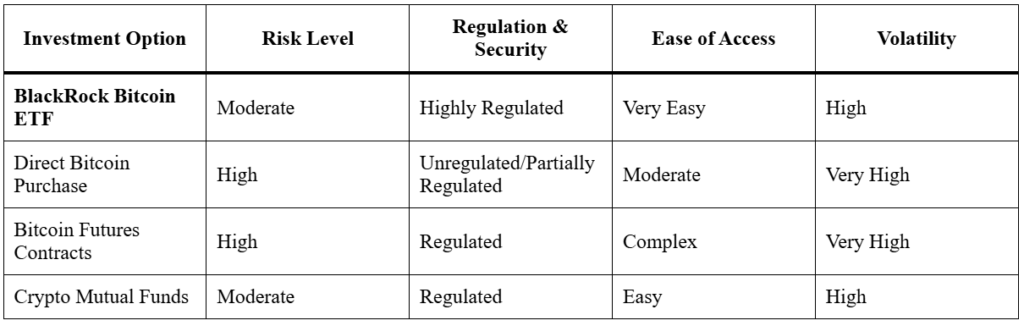

BlackRock Bitcoin ETF vs. Other Investment Options

This comparison makes it clear why institutions favor Bitcoin ETFs over direct crypto ownership. ETFs are regulated, easier to manage, and allow exposure without the challenges of digital wallet security or private key management.

The Bigger Picture for Cryptocurrency

The $116M Bitcoin bet by Harvard’s endowment isn’t just about one university it’s part of a global pattern. Over the past two years, financial giants like Fidelity, Vanguard, and Morgan Stanley have begun offering clients crypto-based products. This trend suggests a slow but steady integration of cryptocurrency into traditional finance.

Moreover, with Bitcoin’s limited supply and increasing demand from institutional players, its long-term price trajectory could remain bullish. Harvard’s move signals confidence not only in Bitcoin’s potential as a store of value but also in the security and transparency offered by regulated ETFs like BlackRock’s.

Final Thoughts

The investment world is evolving, and $116M Bitcoin Bet – Harvard Endowment Invests in BlackRock ETF stands as a landmark moment for cryptocurrency adoption. It proves that even the most established institutions now see value in Bitcoin-backed financial products. As adoption grows, this move may be remembered as a turning point in crypto’s journey into mainstream finance.The investment world is evolving, and Harvard’s $116M allocation to BlackRock’s Bitcoin ETF is a landmark moment for cryptocurrency adoption. It highlights how digital assets are no longer just the territory of tech enthusiasts and retail traders but are becoming a core consideration for some of the world’s largest and most cautious investors.

As more institutions take similar steps, Bitcoin’s role in global finance will likely continue to expand. For everyday investors, this could mean greater stability, higher liquidity, and increased trust in cryptocurrency markets. The $116M Bitcoin bet might just be the beginning of a much larger wave of institutional crypto investments in the years ahead.

🔺 Top 3 Gainers (24h Performance)

- Heima (HEI) – $0.54671 (+37.89%)

Heima surged as new project integrations and growing ecosystem adoption boosted investor confidence. Recent partnerships in the blockchain infrastructure space have driven strong market interest. - FIO Protocol (FIO) – $0.022844 (+35.74%)

FIO Protocol gained momentum following key wallet integration announcements. Its focus on simplifying crypto addresses has sparked renewed adoption among retail and enterprise users. - CoW Protocol Price (COW)) – $0.061995 (+28.78%)

The live price of CoW Protocol is $0.485033 per (COW / USD) with a current market cap of $242.18M USD. 24-hour trading volume is $131.38M USD. COW to USD price is updated in real-time. CoW Protocol is +30.55% in the last 24 hours with a circulating supply of 499.30M.

🔻 Top 3 Losers (24h Performance)

- Treehouse (TREE) – $0.408706 (–8.59%)

Treehouse fell sharply after a slowdown in user growth and reduced market activity. Concerns over roadmap execution weighed on sentiment. - Atletico De Madrid (ATM) – $1.625345 (–5.62%)

The ATM fan token slipped as sports token trading volume cooled. Market focus shifted to other high-yield fan engagement projects. - Arena-Z (A2Z) – $0.007168 (–4.22%)

Arena-Z declined amid reduced play-to-earn game engagement. Lack of new game releases has led to decreased trading volumes.

I’m a passionate content writer who loves crafting clear, engaging, and user friendly content that connects with readers. From blog articles to web copy, I create words that inform, inspire, and leave a lasting impact